An Authentic-Looking Scam Could Cost you Hundreds of Dollars

Published November 29, 2017 at 10:52 pm

We’ve all heard of scams that involve suspicious people posing as officials–think government employees or police–asking for money.

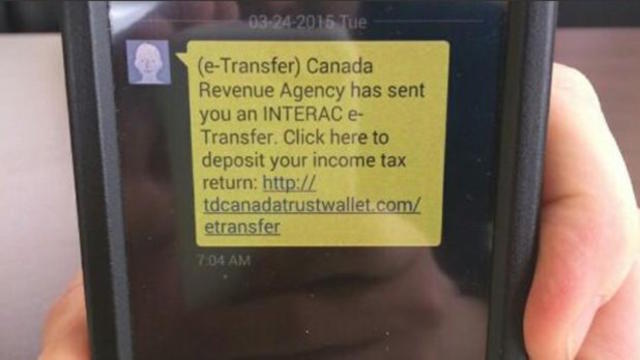

However, some scammers hook you by promising you money in a bid to prompt you to give them your personal information.

As anyone who lives in Canada knows, Canadian Revenue Agency (CRA) scams are a common problem. In some cases, victims are contacted by phone, email or text message and are told they must pay an outstanding income tax balance via e-transfers or, in more bizarre cases, gift cards.

Now, however, it seems that a common CRA scam is potentially bilking people out of hundreds (or even thousands) of dollars by having them input personal information into a bogus form in order to receive money back.

Recently, an inSauga.com reader received an email that appeared to be from the CRA.

The email informed the victim that if he were to click through and input personal and financial information into a form, he would receive a tax return of $403.27 (a clever amount, as it seems legitimate).

Needless to say, it’s unwise to offer personal information to any organization without first confirming they are who they say they are.

And like all other scams, if it seems too good to be true, it probably is.

“Taxpayers should be vigilant when they receive, either by telephone, mail, text message or email, a fraudulent communication that claims to be from the Canada Revenue Agency (CRA) requesting personal information such as a social insurance number, credit card number, bank account number, or passport number,” the Government of Canada warns.

“These scams may insist that this personal information is needed so that the taxpayer can receive a refund or a benefit payment. Cases of fraudulent communication could also involve threatening or coercive language to scare individuals into paying fictitious debt to the CRA. Other communications urge taxpayers to visit a fake CRA website where the taxpayer is then asked to verify their identity by entering personal information. These are scams and taxpayers should never respond to these fraudulent communications or click on any of the links provided.”

If you receive a call saying you owe money to the CRA, you can call the CRA or check your online account (if you have one) to be sure.

Note that the CRA will never:

- Send an email with a link and ask you to divulge personal or financial information (although if you call the CRA to request a form or a link for specific information, a CRA agent will forward the information you are requesting to your email during the telephone call. This is the only circumstance in which the CRA will send an email containing links)

- Ask for personal information of any kind by email or text message

- Request payments by prepaid credit cards

- Give taxpayer information to another person, unless formal authorization is provided by the taxpayer

- Leave personal information on an answering machine

If you get a suspicious email, the CRA advises asking yourself the following:

- Did I sign up to receive online mail?

- Did I provide my email address on my income tax and benefit return to receive mail online?

- Am I expecting more money from the CRA?

- Does this sound too good to be true?

- Is the requester asking for information I would not provide in my tax return?

- Is the requester asking for information I know the CRA already has on file for me?

If you suspect you may be the victim of fraud or have been tricked into giving personal or financial information, contact police. If you think your CRA user ID or the password you use in personal dealings with the CRA has been compromised, contact the agency directly.

insauga's Editorial Standards and Policies advertising